Photo by Acharaporn Kamornboonyarush from Pexels

In a nutshell, if you have owned a home for five years and lived in it for at least two out of five years, or if you’ve owned the house for two years and lived in it the entire time, a single person has a $250,000 tax exemption. If you are married, as a couple, you have a $500,000 exemption. Any gains over those amounts are taxable. You should always discuss the sale of your home with a tax attorney, especially if you used the house for business or rented it out, as you may not be able to take the exemption on homes used for business or as a rental.

Figuring the Tax

Before you can estimate how much tax you might owe, you need to calculate the cost basis for the property. Figure the tax by completing these steps:

Figure the Cost Basis

Add the price you paid for the property to the cost of any significant improvements. Subtract any casualty and theft losses, closing costs you paid when you bought the house and allowable depreciation. You might be able to subtract some closing costs. If you inherited the property, the initial investment is the fair market value on the date of the death of the person who willed the house to you.

For gifted properties, if there is a gain, you use the donor’s adjusted basis in the cost basis equation. If there is a loss, the cost basis is the fair market value on the date you received the property as a gift or the donor’s adjusted basis, whichever is less.

Figure the Capital Gain

Once you have the cost basis, subtract it from the sale price of the house. For example, if you paid $500,000 for your home and you are now selling it for $1,000,000, you have a capital gain of $500,000. If you are single, you will pay tax on $250,000. If you are married, the exclusion is $500,000, which wipes out the $500,000 profit.

Reducing the Tax Owed

You may be able to use the Section 1031 exchange if you are selling a home used for business or that was rented out as long as you buy another house for business or to rent out. The new purchase cannot be for personal use and the exchange must be for “like-kind.”

The regulations for a Section 1031 exchange are limited and may be confusing. Always retain a tax lawyer or accountant to help you with your taxes, especially if you are buying and selling an investment property. If you are selling a million dollar plus home and you use it as your personal residence, you should still contact a tax lawyer. Depending on your finances, the tax lawyer may be able to help you avoid some of the tax.

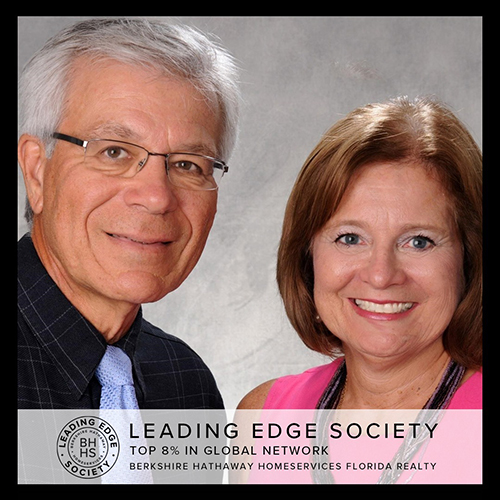

About the Author

Vickie Ventresca and Angelo Ventresca

Angelo Ventresca

239 390-4070

Cell: 716 243-6277

Vickie Ventresca

239 390-4050

Cell: 518 573-0988

Your Brother and Sister Team for real estate in Southwest Florida. Thank you for visiting our website as you search for property in the land of blue skies and sunshine! We hope you find it helpful in familiarizing yourself with the opportunities in Southwest Florida. Your dreams are our focus. Listening to you is our priority. We would be happy to be of assistance in finding your special Florida place, so you can enjoy